Supply chain finance is rapidly becoming a competitive advantage in its own right because it gives companies the power to unlock already existing financial resources to fund new growth and innovation strategies.

Before products get stocked on shelves, there is a lot of work involved behind the scenes — from purchasing materials and coordinating inventory to the distribution of finished goods.

Globalization encouraged longer and more complex cross-border supply chains between suppliers and buyers. Over time, the reliability and quality of deliveries has evolved into an important competitive advantage.

Intrinsically linked together, events in the physical supply chain often coincide with actions taken in the financial supply chain. As companies seek to release working capital tied up in supply chains, they turn to supply chain finance – a set of solutions aimed at optimizing cash flow and accessing liquidity.

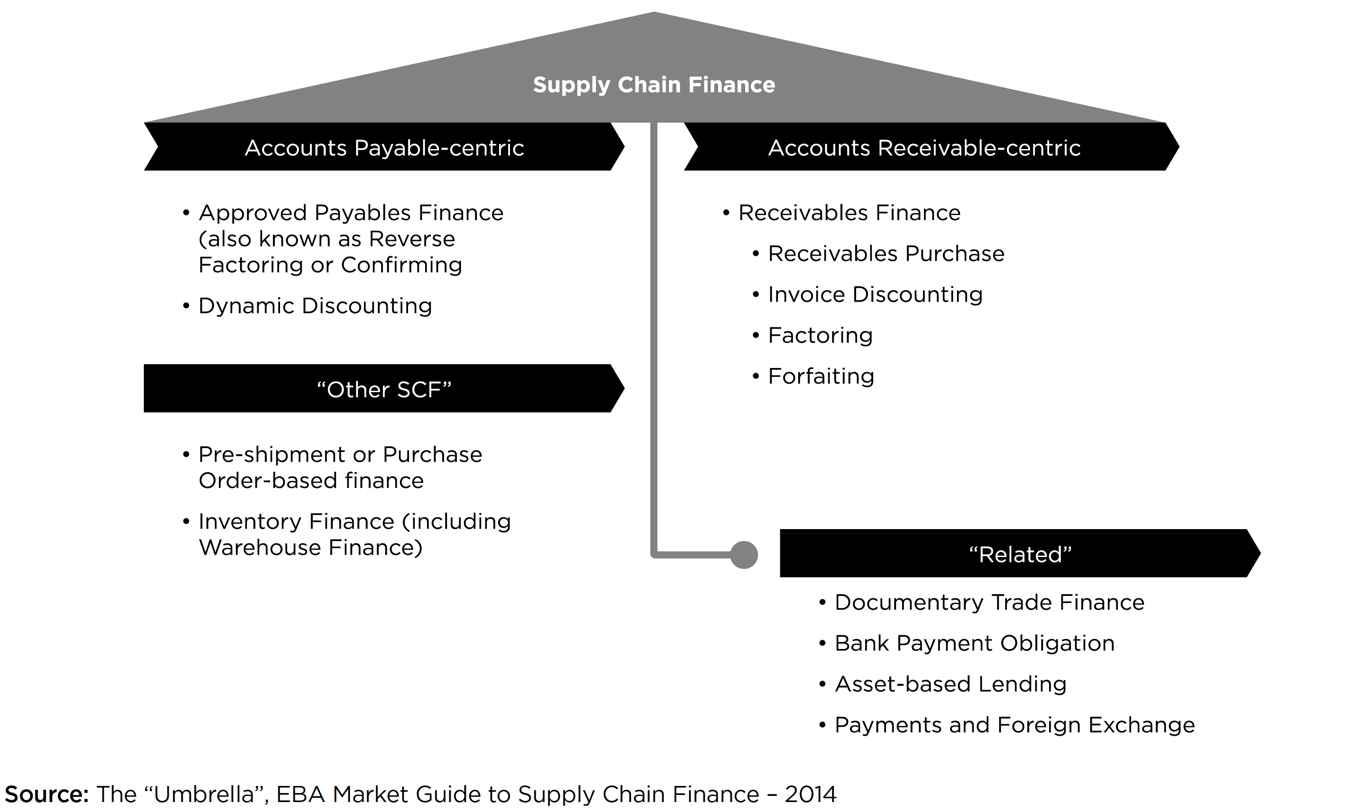

In the light of the growing importance of supply chain finance and the need for clear communication between its stakeholders, the Global Supply Chain Finance Forum was established in January 2014 in an effort to publish and champion a set of commonly agreed standard market definitions for Supply Chain Finance and for SCF-related techniques.

The “Standard Definitions for Techniques of Supply Chain Finance” recommend the following definition for Supply Chain Finance:

“Supply Chain Finance is defined as the use of financing and risk mitigation practices and techniques to optimize the management of the working capital and liquidity invested in supply chain processes and transactions. SCF is typically applied to open account trade and is triggered by supply chain events. Visibility of underlying trade flows by the finance provider(s) is a necessary component of such financing arrangements which can be enabled by a technology platform.”

The Global SFC Forum also promotes a definitional framework that divides SCF into different categories as well as corresponding techniques: